It is possible that until now you have only heard this advice that if possible, do not take a loan at all. Stay away from loans as much as possible, your life will be better. But one thing today is that there are many people whom you are also seeing around you, you must be hearing that Elon Musk has taken a lot of loans. Jeff Bezos has taken a lot of loans. Now such big people are taking loans and they are becoming rich. So, is taking a loan really the secret of rich people?. The answer is yes, taking a loan is the secret of rich people to become wealthy very quickly.

Assets vs. Liabilities: Why the Rich Take Loans Differently

But there is a difference between the way a common person takes a loan and the way a person who is truly becoming rich takes a loan. Now I make a slight distinction that loans are of two types. You can either buy liabilities with a loan or you can create assets with a loan. Now we are going to pay a little attention to both these things. An asset is something that brings money into your pocket. And a liability is something that takes money out of your pocket.

So if you buy a very good car for which you had absolutely no need, but you bought it because you felt like it. So you bought the car for your pleasure, is it earning you money?. If you have not put it in Ola or Uber brother, then it is taking money out of your pocket. It has maintenance, you also fill fuel in it, and it loses its value every day. So it is a liability for you, whether you buy a car or buy a bike, it is one of the same thing.

The EMI Trap: Why Your Lifestyle Loans are Keeping You Poor

There are many people who cannot afford it but are still using the iPhone 13 Pro today. And they talk like this, ‘Man, I feel like buying the new phone.’. ‘Oh, how much will that cost?’ ‘It will cost $1,500, ‘Brother, how much will this one cost?’ ‘It will cost $500, ‘I took this on EMI, paid the EMI, paid the EMI. Now I am selling it and I will buy a $1,500, phone.

People talk like that, right? It’s just a difference of $1,000, they will give that through EMI too. Then life will only go on in EMI. Or people take personal loans. you will see people making financial mistakes too. For example, they do not take health insurance, health insurance people feel is very expensive, but whenever a medical emergency comes up at home and lakhs of rupees are spent, in fact, sometimes a loan has to be taken for the emergency, then that seems cheap to people. But all these are your liability loans that will put you in trouble.

Similarly, when we talk about assets, according to me, there are only two things within assets that your loans will work for. The first thing is either you are taking a loan for business. This business is an asset because it earns money. Or you are taking a loan for real estate.

Now there are some people who might have read the Rich Dad Poor Dad book, they might say, ‘Sir, if we are taking a loan for our house, then the house does not earn us money.’. Robert Kiyosaki says that a house is a liability. But right now we are not going to talk about all houses. We will definitely talk about those middle-class families where people are genuinely earning $1,500 to $6,000 a month today (previously ₹10,000 to ₹50,000), but they too can become rich by taking a loan. It is not just about Jeff Bezos and Elon Musk.

The Real Estate Wealth Framework: Location, Commercial Value, and Rent

So now I am going to focus on this real estate that you will become rich by taking a loan from real estate, and almost no money will go from your pocket into this. Because there are some circumstances where some money might come in, but you understand my concept. I am going to talk straight to the point, I am going to talk step by step, and I am going to give you the exact solution.

You might feel that what you hear exactly today might not be implemented immediately tomorrow, but this framework that you are going to understand today will make you money. So now we talk about becoming rich through real estate. When we talk about real estate, I was having a discussion with my wife and I was telling her that the people who had land, who had real estate, those people were rich. And even after 50 years from today, the truly rich person will be the one who owns land. Because the population is increasing, the population is rising, brother.

We definitely talk about finance on this channel, that you can invest in the stock market, you can invest in gold, you can invest in multiple bonds. But whatever asset class you are talking about investing in, you see this. Look at real estate. When we talk about real, the thing that is with you, that you have actually created in front of you, that is real estate, something significant,

But there is a problem here, a drawback of real estate, that if you want, you can sell gold overnight, you will get cash. You can sell shares in one day, you will get money. If you buy real estate, you might not be able to sell it. So this is a comparatively illiquid market. So before investing money here, one thing needs to be understood, and that is that if you mistakenly bought the wrong property, I repeat, if you mistakenly invested in the wrong property, your money can sink. It might drown because if it doesn’t sell, the money is sunk. So what do we need?

If you invested in a wrong share, it might fall 5% or 10% in one day, you sold it, you came out. You got 90% of the capital back in hand. In real estate, your property might not sell for a whole year, so the market is. That is why the first and most important thing is that in real estate, you must first pay attention to the location.

Someone gave me a very good dialogue, I still remember it today, I will give it to you today. When you buy property, only three things are the most important. If you pay attention to these three things, you will make money. Number one, Location, because nothing is above location in property.

Someone might have built a palace in the middle of a jungle, and someone might have built their hut in a posh area of a city. The hut has more value, who cares about the palace in the jungle?. Understand this, where the roads are good, facilities are good, transportation is good, there are schools, colleges, infrastructure, the property rates will be higher there. Okay, so now what do we need for our strategy?. Number one, we need our real estate to be in a good location.

What is the second thing we need there? That it should be commercial. I will quickly explain what I mean by commercial and non-commercial. What does non-commercial mean? You simply bought a house, bought a flat. What does commercial mean? You bought a commercial shop, you bought a house that is on the road, which falls under commercial which you can rent out. Because in commercial property, you always get more rent. And for non-commercial, we need commercial property because the rent will be higher.

Now if the rent is higher, what magic is going to happen? I will show you the magic now, so keep understanding. The location should be good, and the rent should be high. Now how high?

Let me explain. If you go for non-commercial, you might get approximately 2% to 6%. But if the location is good, if it is a prime location, you can get more than 6% annual rent. Now what is this 6%?. For example, if a property is worth $300,000, how much is 6% of that? Approximately $18,000. Now $18,000 is for the year, how much is it per month? It is $1,500 per month. This is our rent if we get rent according to 6%. What will we try? We will try to get more than 6%, but getting 6% is necessary.

So how will we find this out?. You will find this out like this: whichever property you are interested in, there will be other properties nearby that are currently rented. If you calculate the rent, ‘Yes, brother, sir, have you taken the shop on rent?’ ‘Yes, it is on rent.’ ‘How much rent do you pay?’. He will tell you how much rent he pays. ‘I pay $2,500,’ ‘I pay $1,500 whatever rent he pays. So you will get an idea. So, one has to get an idea like this, because the market of real estate is not like the stock market. It works in very specific areas. The calculations get slightly shaded within every area.

But the principles of making money are the same. Location exists in every area. Whether you live in a large city or a smaller town, good location. So you understand, right? Good location, Commercial, you understand, right?. And you also understand that Commercial will bring higher rent, you understand well.

Mastering the Purchase: How to Find Desperate Deals in an Illiquid Market

Next, the third thing you need to understand is one thing that can make you rich quickly. It is not how much you sold the property for, but how cheaply you bought it. This is a very big rule of business.

The rule that remains today, regardless of the field, whether you talk about clothes or talk about grain. How cheap you buy anything depends on this. The person’s purchasing power should be strong, meaning businessmen will be able to relate to this. The one whose purchasing is excellent will make money. Selling takes a lot of effort, we have talked about selling many times. So here we are talking about purchasing. So what do I need in real estate? I need desperate deals. Now what does this desperate deal mean? It means, for example, you can say some commercial property is worth $300,000.

Brother, I know it is worth $300,000, right? You can estimate the value of nearby shops and say it is $300,000. But it is an illiquid market, illiquid means it will not sell overnight. That person will tell a dealer, ‘Sir, I need to sell it, I need to sell it quickly, I need money. If someone needs money and needs to sell quickly, quickly means it is a desperate deal. ‘Okay, but I will sell it for $260,000 – $270,000. You might feel that such desperate deals do not happen in the market.

You might feel that who will sell their property for so little. And brother, I do not see a puncture shop on the road until my car gets a flat tire. The day it gets a flat tire, that is the day I see the shop that the car has a flat tire, so I start looking for a puncture shop. You did not even need property until now. But if I say today that you can find desperate deals in the market, and if you go looking for desperate deals, you will find them. Because, brother, not everyone has a lot of money in the beginning, no one has unlimited money.

So in the beginning, you will buy only one property, at most two. So if you are going to buy one property, there is no hurry. Because when buying real estate, we cannot make a mistake, and mistakes can happen in haste. So we have to analyze many deals very carefully because payment does not have to be given in one day. So desperate deals are available in the market, where you might get the same property worth $300,000 for $250,000.

But if you go outside and say ‘I am a serious buyer and I will buy this property in one month.’. The standard time given in India is 3 months, they talk standard things that you can pay the money in three months. And if you say, ‘I will buy it in one month,’ you might settle the deal for $220,000 . You give the token amount and you say, ‘Sir, I will lock it at $220,000.

Now you have given the token amount, not 10% which needs to be given, meaning you gave $100, $200, $500, anything, and made an agreement. When 10% has to be given, you get a little time for that. So you sealed the deal by giving a token.

Now what will you do after sealing the deal?. See, now our game starts from here. Because I want you to make money from real estate even without investing money. There is one class that easily gets loans, and that is the salaried class. Otherwise, there is a saying that the bank is ready to give you a loan when you do not need it, and when you need it, the bank does not give a loan. Anyway, so if you are in the salaried class, your chances of getting a loan are higher. For this, what you will have to do is that your salary is coming into the account.

Building Creditworthiness: Preparing Your Profile for a Bank Loan

Firstly, you must show creditworthiness. How will creditworthiness show?. It is good if your CIBIL score is above 750. If it is not today, then those small expenses you make, you get an EMI made. Look, I always say that you can spend with your credit card if you have money in your debit card, then do it. And for the actual necessities of the house, like sometimes you need a fridge, brother, you are bringing a fridge worth $1,000 – $2,000.

You see that the fridge is available on No Cost EMI. So when you are getting it on No Cost EMI and you had the money, then take the EMI. Why? Because this will improve your CIBIL score. You took a small loan, you repaid it. So what does the bank see? That this person is someone who takes a loan and repays it. It is not that it was $500 or $1,000. So if you take a loan and keep repaying it, your CIBIL will keep increasing. If your CIBIL reaches 800 plus, you can easily get a loan. Okay, so you have to build this up.

And if your banking speaks, if your bank statement says that you are constantly receiving salary, you will get a loan according to your salary. So if your creditworthiness is good, if it is not today, then you have to build it. Okay, and try that whenever you receive any income.

If your banking becomes strong, your chances of getting a loan are much higher. Okay, the bank should see that money is coming in. In fact, if you are doing business, and money is coming and going, transactions are happening through the bank, then the bank is ready to give you a loan. File your ITR on time. Now if you file your ITR and do all these things, what will happen? You are a creditworthy person. Now what do you do? You go to the bank.

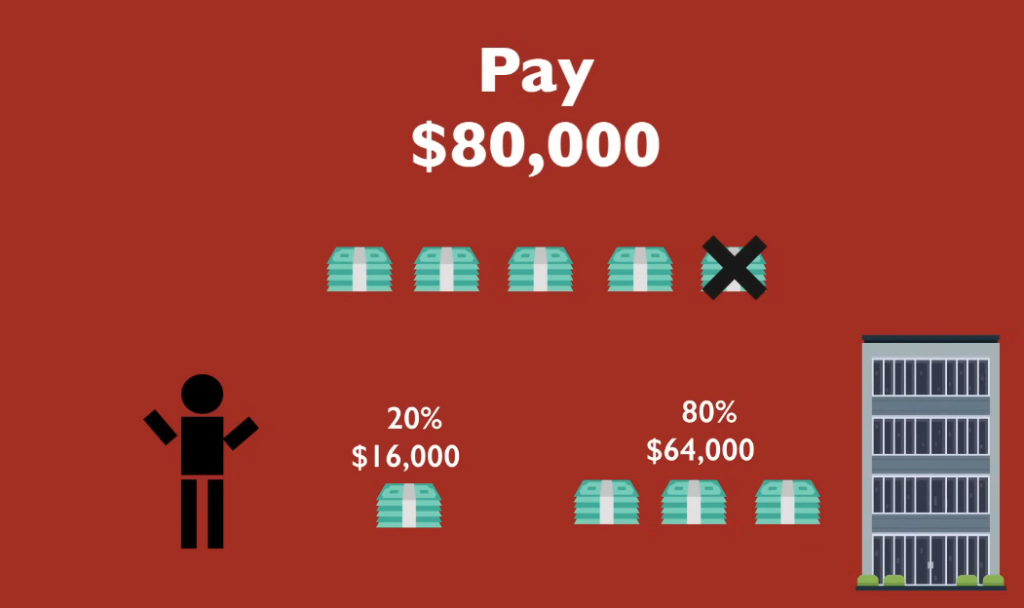

An example is given, ‘Come take a home loan from us at 8.4%. So you will go for a real estate loan, and they are giving it to you at 8.4%. I have taken an example. You picked up a $300,000 deal for $220,000. Okay, you picked up the $220,000, you needed a loan of $220,000. And I say, let’s not stick to 8.4, let’s be practical.

They always say that it starts from here, meaning if you look carefully, 8.4 is the absolute starting category. I assume you get it at 9%. Okay, let’s take a slight buffer, not everyone will get it at this rate, you might get it from some other bank. So you are having to pay 9% rate of interest, and you took the loan for 20 years. So what will you see? Your loan installment, you will say, became approximately $2,000 .

Yes, if they calculate it at 8.4, Sir, there will be a slight difference. Definitely, there will be a difference. For example, if someone gets it at 8%, it comes out to $1,840, and if I do exactly 8.4, it comes out to around $1,900-something. But we keep our calculation absolutely fair, we say we have to pay $2,000, roughly this is the EMI. Okay, so what did we do? Now understand. We picked up a deal from the market for $220,000. We took a property whose actual value is $300,000. It was a desperate deal, it is commercial property, the rent will be good, the location is top. Boom.

Now what will we do? We went to the bank. We said, ‘Sir, the property is worth $300,000, I need a loan of $220,000.’. Let’s proceed practically, it is possible that you might have to put a little money from your pocket as a down payment. But let me tell you this, if you tell the bank that my stamp papers are for $220,000.

So the papers you are going to do are for $220,000, so they give you a loan slightly less than $220,000. But when you tell the bank that I also need to buy some furniture, I also need to do maintenance, the bank can give you a little more loan in the name of this. So, in fact, if you are doing papers for $220,000, they might even give you $230,000. So you can ask for that, it happens. Now we will talk about how this can happen. Okay, so let’s assume I took the entire $220,000 for you on loan, and you did not put anything from your pocket. Wow, isn’t that amazing? It’s amazing.

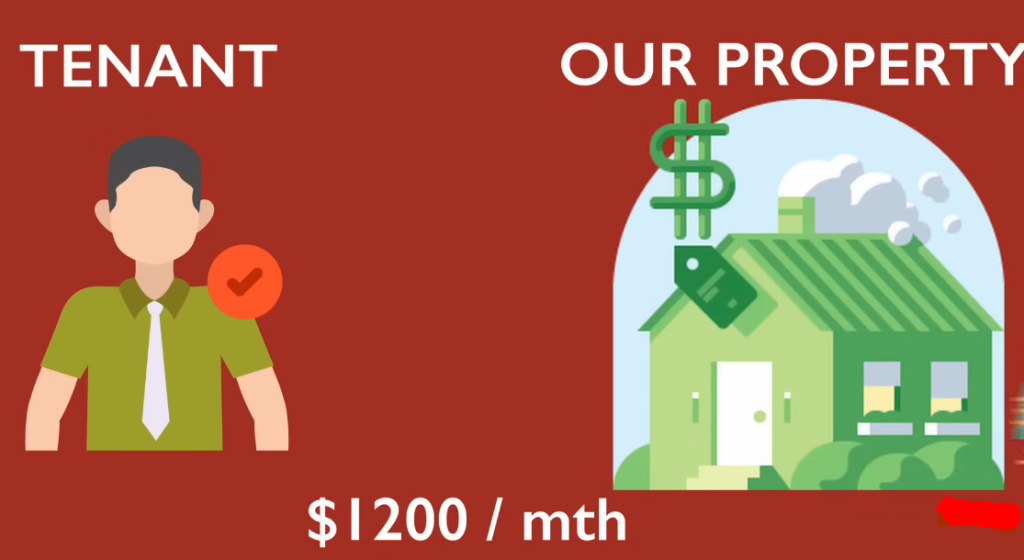

The EMI vs. Rent Formula: How Your Tenant Pays Off Your Loan

Now what did we do? This means the burden has come on the head, $2,000 will go every month. This is my installment, this is the EMI that must be paid. I will say you are 100% right that you have to pay this.

But we saw that this property can be rented out. A question might arise here from you, ‘Sir, we bought the property, it might not immediately rent out. You will see many such developers, meaning new properties are also being built, they give you such assurance that you will definitely get this much rent. Okay, this happens. So there are such plans in the market too. But look there, check RERA, understand everything before you invest in real estate, there is no hurry. But anyway, there is a one percent chance that the property might not be rented out for one month, two months, or even six months.

So you should have a little surplus if you are going to do this. It should not happen that you have absolutely no money, and then we take this slightly risky step. What is the risk? If it is not rented out. But even if you get rent, only $1,500 will come, right?. If our calculation is even 6%, I am not saying more, that would be great. But if you only get $1,500, then $500 will still go from your pocket. I say, yes, absolutely, $500 will go from your pocket. Now you will say, ‘Then we are trapped.’ How are we trapped? You said no money would be taken from the pocket. Let me explain to you.

We are proceeding with general standard things. If you see any property goes on rent, generally there is an 11-month agreement. When they make an 11-month agreement, the agreement states that after 11 months, we standardize this sometimes it is more, sometimes it is less that the rent will increase by 10%. Sometimes it increases by 5%, sometimes it increases more.

So 10% is standard. So if 10% of $1,500 increases after one year, you will get $150 extra. You will say, Sir, it is still only $1,650. The EMI is $2,000. I agree with you. Now next year, you might again get 10% extra. So now you will get $165 extra on the $1,650. Okay, you are getting extra now. After 3 years, your EMI, what is my calculation? Brother, within 3 years, if your EMI and the rent are equal, if they come on par, now you are doing well.

This is good. Why is it good? You spent $500 for 3 years. After 3 years, your property value, the $300,000 thing, after 3 years, brother, it will increase to $350k, $400k, $360k, $320k, something, right?. You will say, ‘Definitely, it will increase. The price of real estate is increasing, and the rent is also increasing. Good.

So one asset of yours is also being created, and the rent is also increasing, let it continue, brother. It doesn’t matter if money is going from your pocket for two or three years. Try to see what will happen after 3 years. After 3 years, there will be magic. Because the rent will be coming in higher, and the EMI will remain the same.

If my EMI is approximately $2,000, it will remain around $2,000, right?. Okay, the EMI payment is $2,000 per month. And if the rent comes in higher, say $2,200 or $2,500, which will definitely increase after 5 years, if not today. If you get more money, why? Because we have to become rich in the long term. This is just the beginning of you becoming rich. Firstly, we have to finish the loan as quickly as possible. We will not necessarily run it for 20 years.

We will earn more tomorrow than what we earn today. And if we get higher rent, then I show you the stock market. What will you do with that extra money if it is coming every month?. You can simply do an SIP, right?. If you do an SIP, for example, I assume that you started getting $500 extra. Whenever it started coming, and if you get a decent return of approximately 18%, how much will this money become in 20 years?. It will become $1.2 million.

You put money from your pocket for the first two or three years. The property was created. After 20 years, friends, that property will also be worth several crores. The property became worth crores, and the extra money that kept coming in. We talked about $500 coming in.

But brother, even 10 years from today, will you only get $500 extra from that rent?. More can also come, $600, $700, $800 can also come. So if more extra money comes, this amount will be something else. But there is a calculation, that is why I took those initial three years. In those three years, you did not invest $500. So you are becoming rich through investment, you are becoming rich through real estate.

The Ultimate Wealth Loop: Combining Real Estate Equity with SIP Returns

Now how can you do SIP?. For that, you only need a Demat account. For example, to help you all, I will put the link for Upstox in the description and comment box. It is India’s leading broker, a discount broker, where you can invest in the stock market, you can trade, you can do SIP, you can invest in mutual funds. And if you open an account, there are also latest offers running on it right now. Here you can also earn money through referral.

You can also earn money if you want to earn money online, you can earn money through affiliate marketing too. You just have to open an account, then you can go to reference and send your link to any friend, through which you can earn money. So people are already tagging me on Instagram who are earning good money. So this is what you can do with your SIP and real estate. So you have created your asset. Now, in this example, which we explained, it is fine, brother, there is a struggle of one, two, three years in the beginning.

And there might be some permutations and combinations, like sometimes a tenant might vacate for some time, and if it doesn’t get rented for one or two months, what will happen?. These ‘if and buts’ can arise. But then we also did not include the ‘if and but’ that you might get more than 6% rent. And your own asset is being created, brother. So remember this, today and even 50 years from today, those people will be rich who have their own real estate. So focus on building and developing real estate.

The most important purpose in this was that you should not take loans for liabilities, you can take them for asset building. We tried to give an example of how you can become rich from this.